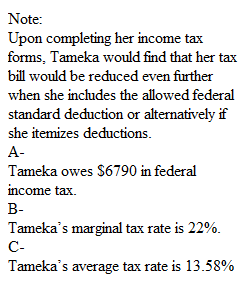

Q 2020 Individual Tax Rate Schedule—Single Taxpayers If Taxable Income is Over... But Not Over... The Tax is... of the Amount Over $ 0 9,875 .......... 10% $ 0 9,875 40,125 987.50 + 12% 9,875 40,125 85,525 4,617.50 + 22% 40,125 85,525 163,300 14,606.50 + 24% 85,525 163,300 207,350 33,271.50 + 32% 163,300 207,350 518,400 47,367.50 + 35% 207,350 518,400 ........ 156,235 + 37% 518,400 ________________________________________ Examples Question: If Jaime earns $10,000 from a job that he works after school and during the summer, how much federal income tax does he owe given the table above? Jamie also has $500 of non-taxable income. Answer: ($9,875 x .10) + ($10,000 - $9,875 x .12) = ($987.50 + $15) = $1,002.50 owed in taxes Question: What is Jaime’s marginal tax rate, that is on the highest dollar? Answer: 12%. This means that Jaime is in the “12% tax bracket.” Question: What is Jaime’s average tax rate? Answer: This is $1,002.50 ÷ $10,000 = 10.03%. Jaime’s average tax rate (liability) is less than is marginal tax rate because not every dollar of income was taxed at the highest rate. The first $9,875 was taxed at 10% and the next $125 was taxed at 12%. Question: What is Jaime’s effective tax rate? Answer: This is $1,002.50 ÷ $10,500 = 9.5%. This is the tax based on both taxable and nontaxable sources of income. Question: Suppose the personal exemption for Jaime is $3,700. How much federal tax would he owe? Answer: Taxable income = ($10,000 - $3,700) = $6,300 Question: How does this change Jaime’s marginal tax rate? Average tax rate? How much taxes does he now owe? Answer: Jaime’s marginal tax rate is now 10% for all of his taxable income. ($6,300 x .10) = $630 owed in taxes. Jaime’s new average tax rate is = $630/$6,300 or 10%, equal to his marginal rate because all of his taxable income is in the lowest tax bracket. ________________________________________ Directions: After reviewing the examples above, answer the following questions using the 2020 Individual Tax Rate Schedule for a single individual. Submitting your answers to this assignment will allow you to access the answers to these practice questions and continue to the next lesson. If Tameka earns $50,000 from her job as an accountant, how much federal income tax does she owe based on the above table? Tameka also has $10,000 of non-taxable income. What is Tameka’s marginal tax rate, that is, on the highest dollar? What is Tameka’s average tax rate? What is Tameka’s effective tax rate? Suppose the personal exemption for Tameka is $3,700 for herself and $3,700 for each of her 3 children. How much federal tax would she owe? How much in taxes does she now owe? How does this change Tameka’s marginal tax rate? What is her new average tax rate? What is her effective tax rate? Note: Upon completing her income tax forms, Tameka would find that her tax bill would be reduced even further when she includes the allowed federal standard deduction or alternatively if she itemizes deductions. PreviousNext ? Marginal Effective Tax Rate Practice Directions: After reviewing the examples above, answer the following questions using the 2020 Individual Tax Rate Schedule for a single individual. Submitting your answers to this assignment will allow you to access the answers to these practice questions and continue to the next lesson. A. If Tameka earns $50,000 from her job as an accountant, how much federal income tax does she owe based on the above table? Tameka also has $10,000 of non-taxable income. B. What is Tameka’s marginal tax rate, that is, on the highest dollar? C. What is Tameka’s average tax rate? D. What is Tameka’s effective tax rate? E. Suppose the personal exemption for Tameka is $3,700 for herself and $3,700 for each of her 3 children. How much federal tax would she owe? F. How much in taxes does she now owe? How does this change Tameka’s marginal tax rate? What is her new average tax rate? What is her effective tax rate?

View Related Questions